Compliance Overview

It is important to follow regulations for domestic shipments, and ensure export compliance.

Springcontacts.com is developing infrastructure and technology to empower our niche of the electronics industry, particularly for international e-commerce, or cross-border e-commerce.

Global e-commerce is growing, and here to stay, so Sellers expanding internationally should educate themselves up on the nuances involved in international fulfillment.

Fulfilling orders for buyers located in a different country than the Seller requires goods to be exported, which means they become subject to increased regulations over an order that is shipped domestically.

Given the expansion of compliance regulations, merchants of all sizes must learn how to navigate processing and exporting cross-border shipments. Traditionally, this responsibility fell more to manufacturers and suppliers, but in the changing economy, it’s a concern to anyone doing international business, including online marketplaces.

We are taking steps to bolster our international e-commerce support. Below are topics with information relative to various forms of compliance relative to our industry.

RoHS / WEEE

In February of 2003, the European Union released the RoHS and WEEE Directives (Restriction of Hazardous Substances / Waste Electrical and Electronic Equipment), often referred to as the Lead-Free directives.

As part of our efforts to provide the most current and accurate information on all spring contact and test probe products, we ask that you contact

Sellers directly via the communication tools on the site to determine

whether products comply with the requirements of the RoHS directive on

hazardous substances either directly by utilizing RoHS compliant

materials and finishes or through specification controlled products

which offer an RoHS compliant alternative.

Certain Sellers may specifically identify the RoHS status, among additional specification information, for your specific product.

DFARS

With regard to DFARS Specialty Metals Restrictions, electrical and fiber-optic connectors likely fall under the exception for electronic components under 252.225-7009(c). Contact the Seller directly for more information.

HTS Code versus an HS Code

In order to import goods, merchants, suppliers and manufacturers are required to provide a code that determines the tariff or duty rate of the traded product. This code also helps countries that track import and export numbers keep a record of international trade statistics.

An HS Code is a universal 6-digit product code and is used worldwide, regardless of country of import. An HTS Code, however, is specific to the United States and is required for importing and exporting goods. An HTS Code starts with the standard 6 digits, but also includes 4 additional digits, making it 10 digits long (the additional 4 digits are used to identify subcategories).

While the HS Code is universal, capturing only the 6-digit code may cause delays when a product is being shipped to a location outside of the U.S. When exporting goods from the U.S., an order will be placed on hold if the product is valued over $2,500, as it may require additional paperwork. By having the 10-digit HTS Code included by a Seller in advance, logistics and compliance personnel can quickly determine whether an Electronic Export Information (EEI) filing is necessary.

An HTS Code is one that anyone importing or exporting from the U.S. should familiarize themselves with, and be sure to request, if required. This allows proactive prevention of delays related to export compliance, should the code be needed for exporting/importing an order.

Export Control Classification Number (ECCN)

The ECCN can be up to 11 digits long and is used to categorize items based on the Commerce Control List (CCL) for export control purposes. The CCL is divided into 10 categories. If your product falls into one of the 10 categories, it will require an export license from the Department of Commerce. If your product is not listed on the CCL (the majority of commercial products are not) it will be designated as EAR99 and typically will not require an export license.

Be sure to request ECCN inclusion in the documentation for international orders so your shipment will not be held up during processing, and the necessary data to export is on hand for logistics authorities. This can eliminate potential delays in a merchant’s cross-border fulfillment process and increase the speed of delivery. Should a product fall within one of the categories on the CCL, Sellers can, and should, process the necessary paperwork to ensure that the order complies with U.S. government regulations.

Denied Parties / RPL

U.S. government regulations state that it is illegal to export goods, regardless of their nature, to a person or entity on the denied party list. Fines for violating this can reach up to $1M per violation in criminal cases, according to the U.S. Department of Commerce’s Bureau of Industry and Security (BIS). Additionally, administrative cases could result in a penalty of more than $250,000, or two times the value of the transaction.

Many of our Manufacturers and/or Sellers may have implemented industry standard compliance methods to check the name of a customer on any outbound order against the Restricted Party List (RPL), which includes denied persons, entities and unverified lists.

Screening against the RPL is done to protect Manufacturers and Sellers against fines and punishment resulting from shipping to a restricted party. A small percentage of export orders generate a high match to a name on the RPL, and by screening, our Manufacturers and Sellers can ensure export compliance regulations are met.

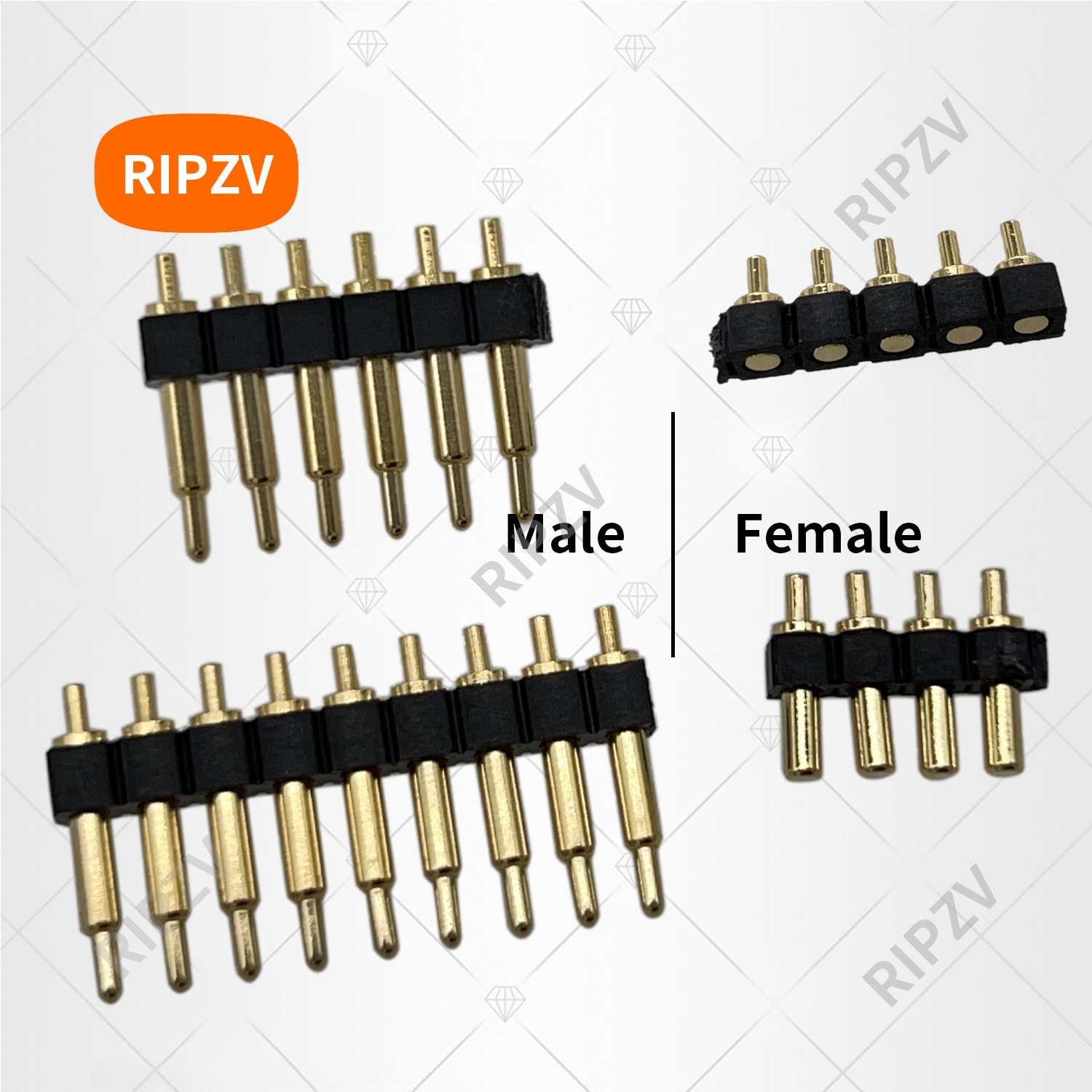

1pcs 3.0mm Pitch SMT DIP ...

1pcs 3.0mm Pitch SMT DIP ...  1pcs Male / Female Spring...

1pcs Male / Female Spring...  5Pcs Pogo Pin Connector P...

5Pcs Pogo Pin Connector P...